Phishing campaigns spoof Citizens Bank, Wells Fargo

Phishing scams impersonating major banks are active now. Learn how to recognize them before your financial data is stolen.

Tyler Moffitt

3 min read

Recently AppRiver's Email Security filters have seen a flood of phishing campaigns using Wells Fargo and Citizens Bank templates.

The attacker's goal is to intercept the user's bank login information, and we all know what that could lead to - financial devastation.

From a previous article we did on phishing, Spotify Phishing Campaign Making the Rounds, we discussed how to spot a phishing email. One of the indications was the From Address stating the email was from the official domain. In the samples below, you will see that the From Address has been spoofed in an attempt to trick the recipient into believing they are receiving an email from an official organization or person.

Here is one of the samples AppRiver intercepted:

At first glance, this email appears to be from Citizens Bank, even the From Address says "citizensbank.com," which is an official domain for the banking institution. Because of that, the From Address would probably not raise any red flags.

However, let's look at the To Address. RED FLAG! In the sample provided, the attacker used "undisclosed-recipients," which means the email was sent to many people and the email addresses were undisclosed. This tactic is quite common in large phishing campaigns. It is important to note that legitimate bank institutions always will use a recipient's name in the To Address.

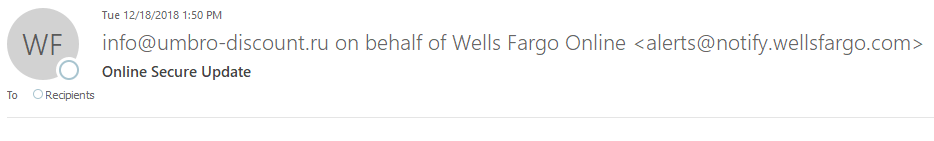

Let's take a look at the Wells Fargo phishing campaign. As you can see, it is very similar to the Citizens Bank scam.

Just like the Citizens Bank phishing campaign, the payload is a link that will redirect you to a deceptive website that asks for your bank credential.

If these scammers get a hold of your bank login information, it goes without saying it could cause you serious financial damage. Once inside your account, the attackers have the ability to transfer money and gain access to more personal information.

If your bank account has been hacked by this or any method, call your bank immediately. Your bank will help mitigate the damage as much possible.

As an account holder, you should enable multi-factor authentication (MFA) - assuming your bank offers it - to help thwart a cybercriminal from gaining access to your money.

Multi-factor authentication will provide an extra step for you to gain access to your account. Typically with MFA, you will be prompted for a second credential that is sent via your preferred method (text, email or call). Once you enter in the code, you gain access to your account. Though MFA is not foolproof, it can slow down a scammer and hopefully help you avoid losing money.

As mentioned, always make it a best practice to check the URLs in every email message you receive - no matter how legitimate they look. When in doubt, don't click on anything within the message - or, if you have suspicions from the beginning, do not open the email.